By Anthony P. Guettler, Esq., Gould Cooksey Fennell, Vero Beach, Florida

Limited liability companies (“LLCs”) are regularly used by senior family members to carry out their estate planning goals. An LLC can be used as a vehicle to manage the family’s wealth, protect assets, and transfer economic ownership to younger generations while allowing the senior generation to retain control. An LLC allows for a custom, flexible plan for asset management, business succession, and protection of family wealth. Estate planners most commonly associate LLCs with business succession planning, asset protection and tax efficient wealth transfer from senior to lower generations. However, LLCs can also accomplish several important estate planning objectives for married couples.

For example, many couples desire to establish one or more irrevocable trusts for the surviving spouse (“Trust for Surviving Spouse”) to protect the trust assets from creditor claims and divorce from a subsequent spouse, and to utilize the deceased spouse’s estate and generation-skipping transfer tax exemptions. However, if the couple’s primary financial assets are owned jointly with rights of survivorship (“JWROS”), this will require dividing assets that have traditionally been jointly owned (unless the couple is comfortable with disclaimer planning). In some cases, spouses will be reluctant to divide and separate their primary assets. An LLC can be used to bridge the gap between separate ownership and joint control. With an LLC, the couple can maintain joint management and control over all assets, and each spouse’s interest in the LLC can be transferred under his or her estate plan to a Trust for Surviving Spouse. The same approach can also be useful in situations where one spouse owns the majority of the couple’s primary financial assets. An LLC can be used to shift value to the other spouse while allowing the transferring spouse to retain control.

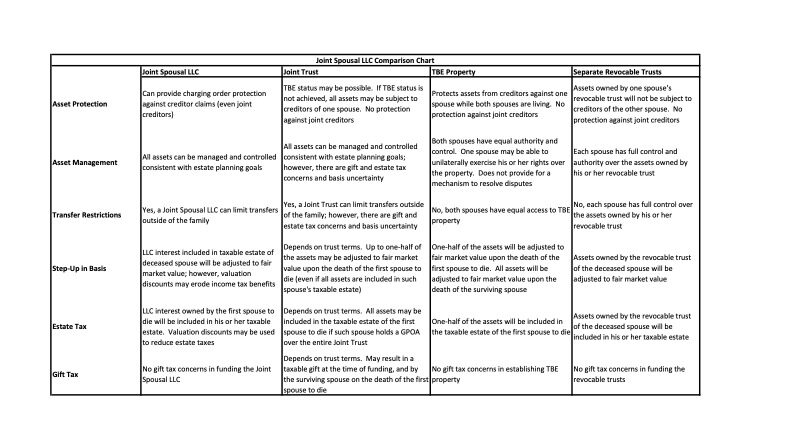

The purpose of this article is to examine how a limited liability company established by spouses (“Joint Spousal LLC”) could accomplish several important estate planning goals for married couples living in non-community property states that desire joint management and control, asset protection and restrictions on transfers. This article compares the Joint Spousal LLC to property owned JWROS, and planning with joint revocable trusts in non-community property states (“Joint Trust”).

Funding Separate Revocable Trusts

The Joint Spousal LLC could be funded with the couple’s primary financial assets, and the LLC’s equity could be divided between the couple in any percentage they deem appropriate. For purposes of this article, we will assume equal ownership by each spouse. With this structure, each spouse’s one-half A Comparative Study Of The “Joint Spousal LLC” By Anthony P. Guettler, Esq., Gould Cooksey Fennell, Vero Beach, Florida interest in the Joint Spousal LLC would pass according to the terms of his or her separate revocable trust. For married couples that desire to establish a Trust for Surviving Spouse upon the death of the first spouse (and do not want to rely on disclaimer planning), the ability to fund each revocable trust with a onehalf interest in the Joint Spousal LLC is an important benefit over assets owned JWROS. It should be noted that the same result could be accomplished by simply dividing the assets and transferring one-half to each spouse’s separate revocable trust. However, some clients may prefer a structure that requires joint management of all assets and may be uncomfortable relinquishing control as to a portion of the combined wealth.

Asset Management

The Joint Spousal LLC could be a manager-managed limited liability company with both spouses serving as managers. The operating agreement may set forth the provisions governing the management of assets owned by the Joint Spousal LLC and can require that significant distributions and other major decisions be approved by both spouses. The ability to draft provisions that govern how the assets will be managed and distributed is an important benefit of the Joint Spousal LLC. With most jointly owned financial accounts, each spouse has the unilateral right to withdraw the funds at any time, and there is no ability to modify bank rules governing management and distributions. With separate ownership, each spouse will have control over the assets in his or her revocable trust (which may not be consistent with the couple’s estate planning goals).

In the event of a deadlock, the operating agreement may provide for a mechanism to resolve the disagreement. For example, an advisory board consisting of one or more family members could be appointed to serve as the tiebreaker. The ability to determine how disputes will be resolved is an advantage over jointly owned property. The Joint Spousal LLC provides significant flexibility in planning for disability and death. The operating agreement may set forth the provisions governing the management and distribution of assets upon disability of a spouse and during the lifetime of the surviving spouse. The operating agreement may require that an independent party serve as co-manager with the remaining spouse after the death or disability of the other spouse. In comparison, analogous protective planning can be achieved by dividing assets between the married couple’s separate trusts and incorporating appropriate protective provisions for each spouse’s death or disability, however, such planning would not restrict the surviving or non-disabled spouse’s unilateral control over the assets in his or her trust. Additionally, analogous protective planning is not possible with jointly owned property.

Although the Joint Trust is also a good option from an asset management perspective (especially in the event of death or disability), the Joint Trust implicates a number of tax issues[1] that can be avoided with the Joint Spousal LLC.

Asset Protection

With a multi-member limited liability company, a creditor seeking to enforce a judgement against a member owning an interest in the LLC would be limited to obtaining a charging order against that member’s interest.[2] Although charging order protection is beneficial, greater protection can be achieved by a married couple during their joint lifetimes through joint ownership of assets as tenants by the entireties (“TBE”). TBE property may not be used to satisfy either spouse’s individual debts (but may be used to satisfy a joint liability).[3] The primary disadvantage of relying on the creditor protections of TBE property is that after the first spouse’s death, the assets pass automatically to the surviving spouse and could then be used to satisfy the debts and liabilities of the surviving spouse.

Upon the first spouse’s death, the interest in the Joint Spousal LLC owned by such spouse could be transferred to a Trust for Surviving Spouse. With property owned JWROS, the interest owned by the first spouse to die passes directly to the surviving spouse (not in trust). Although it is possible to fund a Trust for Surviving Spouse upon the death of the first spouse to die with property owned JWROS, this would require a disclaimer by the surviving spouse. This disclaimer planning may subject the assets to creditor claims.

The asset protection features of a Joint Trust depend upon the terms of the trust. There can be significant asset protection benefits if the Joint Trust can be structured as TBE property.[4] However, if the Joint Trust is structured so that all assets may become subject to the creditor claims of just one spouse, the couple would be better off maintaining separate ownership.

Transfer Restrictions

If protecting assets from passing outside the family is an important goal, the Joint Spousal LLC can be a useful tool. The operating agreement for the Joint Spousal LLC may be drafted to restrict each spouse’s ability to transfer his or her membership interest to persons outside the family. In addition, the operating agreement can require transfer restrictions to remain in place during the lifetime of the surviving spouse. The ability to limit transfers by the surviving spouse is a protection often sought by a married couple and can help keep the assets of the Joint Spousal LLC within the initial class of beneficiaries. Similar protections and limitations are possible with a Joint Trust; however, the estate and gift tax issues associated with Joint Trusts may be a significant hurdle.[5]

Income Tax and Tax Basis

In establishing the Joint Spousal LLC, the couple should elect federal income tax treatment as a partnership. In general, no gain or loss will be triggered in funding a Joint Spousal LLC that elects to be treated as a partnership for federal income tax purposes.[6] One exception to this general rule is for a partnership classified as an investment company under I.R.C. §721(b). When contributing appreciated securities to a Joint Spousal LLC, couples should avoid having the Joint Spousal LLC classified as an investment company.

Upon the first spouse’s death, the interest in the Joint Spousal LLC owned by such spouse will be included in his or her gross estate,[7] and the basis will be adjusted to its fair market value as of the date of the first spouse to die.[8] The fair market value of the interest in the Joint Spousal LLC owned by the first spouse to die may be subject to discounts for lack of control and lack of marketability under the principles of Rev. Rul. 59- 60.[9] If valuation discounts apply, the resulting lower valuation may reduce (or potentially eliminate) any benefits from a step-up in basis. Additionally, the Joint Spousal LLC could make a “754 election” allowing the partnership to increase the inside bases of partnership assets pursuant to Internal Revenue Code §743(b). From a basis adjustment planning perspective, the Joint Spousal LLC structure has significant drawbacks when compared to property owned JWROS. In the case of property owned JWROS by a married couple in a noncommunity property state, one-half of the joint assets will be included in the estate of the first spouse to die and receive a basis adjustment.[10]

Upon the death of the surviving spouse, the surviving spouse’s interest in the Joint Spousal LLC will be included in his or her gross estate, and the basis in such interest will be adjusted to fair market value as of the date of such spouse’s death.[11] Additionally, the Joint Spousal LLC could make another 754 election as well. However, as mentioned above, it is likely that valuation discounts will apply, and the step-up in basis will be reduced as a result of the lower valuation. With jointly owned property, the surviving spouse would own all of the assets at the time of his or her death, and the basis of all assets included in such spouse’s taxable estate would be adjusted to fair market value (with no valuation discounts applicable).[12] The ability to receive a step-up in basis on all assets owned by the surviving spouse at the time of his or her death is a significant benefit if the assets have appreciated in value.

With a Joint Trust in a non-community property state, it can be difficult to determine what portion of the assets will receive a step-up in basis at death. For example, unless the first spouse to die holds a general power of appointment (“GPOA”) over the entire Joint Trust at his or her death, it may be difficult to determine what portion of the assets owned by the Joint Trust will be included in the taxable estate of the first spouse to die; as result, it can be difficult to determine what portion of the assets will receive a step-up in basis.[13] Further, even if the first spouse to die holds a GPOA over the entire Joint Trust at his or her death, it may not be possible to achieve a full step-up in basis on all assets owned by the Joint Trust.[14]

Estate Tax

On December 22, 2017 the Tax Cuts and Jobs Act was signed into law. The new tax law essentially doubles the previous federal estate, gift and GST tax exemption levels. Under the new law, exemption levels will be increased to approximately $11,180,000 per person ($22,360,000 combined for a married couple).[15] It is important to keep in mind that the increased exemption levels are set to expire and be reduced by half on January 1, 2026.

For married couples that may still face an estate tax, the Joint Spousal LLC can have advantages over jointly owned property. One advantage is that each spouse’s separately owned interest in the Joint Spousal LLC may be used to fund a credit shelter trust, designed to utilize the deceased spouse’s generationskipping transfer tax exemption. Note, it is also possible to fund a credit shelter trust with property owned JWROS; however, this would require a qualified disclaimer by the surviving spouse, which would not be possible if the surviving spouse accepts “the interest or any of its benefits” before making the disclaimer.[16] With the advent of portability, it is not as critical to fund a credit shelter trust – at least not from a federal estate tax perspective. However, before relying on portability, there are a number of factors to consider including GST tax planning, the last deceased spouse rule and state death taxes.[17]

Another advantage of the Joint Spousal LLC is that the value of the interest being transferred may be subject to discounts for lack of marketability and lack of control.[18] One way to reduce estate taxes is to transfer a non-controlling interest in the Joint Spousal LLC to a trust that is not included in the transferring spouse’s taxable estate. As an example, a minority interest in the Joint Spousal LLC could be transferred to an irrevocable spousal access trust. It should be noted that there are estate tax planning opportunities for certain types of joint property as well. For example, if a married couple owned a tract of land as tenants in common, the value of each spouse’s separate fractional interest in the property may be subject to valuation discounts.[19]

With a Joint Trust, it is possible that only half of the assets will be included in the taxable estate of the first spouse to die; however, depending on the terms of the trust, the IRS may take the position that the entire value of the Joint Trust will be included in the taxable estate of the first spouse to die.[20] In addition, if the Joint Trust seeks to establish a credit shelter trust for the surviving spouse, careful drafting is required to ensure that the credit shelter trust is not included in the taxable estate of the surviving spouse.[21] A possible solution to protect against the credit shelter trust being included in the surviving spouse’s taxable estate is to grant the first spouse to die a GPOA over the entire Joint Trust at his or her death.[22] A GPOA will ensure that all assets are included in the taxable estate of the first spouse to die and, as a result, the first spouse to die is treated as the transferor for transfer tax purposes.[23]

Gift Tax

In general, there are no gift tax consequences upon the creation or funding of the Joint Spousal LLC if the Joint Spousal LLC is owned exclusively by a married couple (or their respective revocable trusts).[24] Similarly, there are generally no gift tax issues in establishing jointly owned property between a married couple.[25] One important exception to this general rule will be in cases where the transferee spouse is not a U.S. citizen.[26] If the transferee spouse is not a U.S. citizen, the unlimited gift tax marital deduction is not applicable, but the annual exclusion limit is increased to $100,000 adjusted for inflation (which was equal to $149,000 in 2017).[27]

Careful drafting is required to avoid taxable gifts at the time of funding and upon the death of the first spouse with a Joint Trust. In order to avoid making a taxable gift at the time of funding, each spouse could retain the unilateral right to terminate the Joint Trust and receive the property he or she originally contributed to the Joint Trust (including property into which the original property was converted).[28] If the Joint Trust becomes irrevocable upon the death of the first spouse, the Joint Trust will need to grant the surviving spouse sufficient power to direct or invade the principal of the Joint Trust to avoid a completed gift by the surviving spouse to the remainder beneficiaries.[29]

Conclusion

The Joint Spousal LLC applies the principles traditionally used by senior generations in planning with LLCs for business succession to estate planning for married couples. The Joint LLC is most useful in situations where a married couple desires joint asset management, wants to limit transfers outside the family, is facing the possibility of an estate tax and has an estate plan that contemplates the establishment of a Trust for Surviving Spouse without disclaimers. It is important to note that although the Joint Spousal LLC can be useful, it may add complexity and expense to the estate plan and may not be appropriate in situations where simplification is an important goal.

Endnotes: Thomson Reuters, Checklist of tax dangers in use of joint revocable living trusts, 33,207 Planning Articles, Thomson Reuters/Tax & Accounting (2018). 2 §605.0503 Fla. Stat. (2014). 3 Beal Bank, SSB v. Almand & Associates, 780 So.2d 45 (Fla. 2001); First Nat’l Bank v. Hector Supply Co., 254 So.2d 777 (Fla. 1971). 4 Craig Harrison, Trusts: TBE or Not TBE, 87 Fla. Bar J. 30 (2013) (discussing the creation of a tenancy by the entirety trust). 5 Id. at 1. 6 I.R.C. §721(a), (b). 7 I.R.C. §2031(a). 8 I.R.C. §1014. 9 Rev. Rul. 59-60, 1959-1 CB 237. 10 I.R.C. §2040, Id. at 8. A. GUETTLER A Comparative Study Of The “Joint Spousal LLC,” from page 28 11 Id. at 7-8. 12 Id. at 7-8. 13 I.R.C. §2041, Thomson Reuters, How much of trust is included in estate of first dying spouse-grantor?, 33,210 Planning Articles, Thomson Reuters/Tax & Accounting (2018). 14 P.L.R. 9308002, 11/16/1992, IRC Sec(s) 1014. 15 Howard Zaritsky, Tax Cuts and Jobs Act Does Not Quite Double the Applicable Exclusion Amount and GST Exemption for 2018, 17 Howard Zartisky’s Estate Planning Update, 22 (1/15/18). 16 I.R.C. 2518. 17 Lester Law and Andrew T. Huber, Estate Planning with Portability in Mind, Part I, 86 Fla. Bar J. 29 (March 2012), Lester Law and Andrew T. Huber, Estate Planning with Portability in Mind, Part II, 86 Fla. Bar J. 25 (April 2012). 18 Id. at 9. 19 Katherine A. Gilbert and C. Ryan Stewart, Valuing Real Estate Fractional Ownership, 92 Intangible Asset Valuation Insights (Summer 2010). 20 Thomson Reuters, How much of trust is included in estate of first dying spousegrantor?, 33,210 Planning Articles, Thomson Reuters/Tax & Accounting (2018). 21 Thomson Reuters, Use of a joint revocable living trust can hinder estate tax planning with credit shelter trust, 33,212 Planning Articles, Thompson Reuters/ Tax & Accounting (2018). 22 Louis S. Harrison, Joint Trusts in Separate Property States: “Just Say ‘Yes’ . . . Sometimes”. https://www.flprobatelitigation.com/wpcontent/uploads/ sites/206/2013/08/Joint_Trusts_in_Separate_Property_States.pdf. 23 Id. at 20. 24 I.R.C. 2523. 25 Id at 24. 26 I.R.C. 2523(i). 27 Thomson Reuters, Annual exclusion amount for gifts to noncitizen spouse, 48,204 Estate Planning Analysis, Thomson Reuters/Tax & Accounting (2018). 28 Thomson Reuters, Funding a joint revocable living trust may give rise to immediate taxable gifts, 33,208 Planning Articles, Thomson Reuters/Tax & Accounting (2018). 29 Thomson Reuters, Death of first spouse may result in taxable gift by surviving spouse, 33,209 Planning Articles, Thomson Reuters/Tax & Accounting (2018).

This article was originally published in the Summer, 2018 issue of ActionLine, a Florida Bar Real Property and Trust Law Section publication.