The Gould Cooksey Fennell Blog

Uninsured Motorist Coverage in Florida

Uninsured Motorist Coverage can be a valuable benefit in the event someone injures you in a car accident. Florida is one of the few states that does not require bodily injury insurance. David Carter, car accident attorney and Personal Injury Attorney in Vero Beach, talks on the importance of having

Attorney Jason Odom Published in the Florida Justice Association Journal

Personal injury litigation often involves complex, intertwined legal issues. Gould Cooksey Fennell Personal Injury lawyer Jason Odom recently published an article in the July/August 2020 edition of the Florida Justice Association Journal on the topic of joint tortfeasors, comparative fault, and common defenses such as Fabre and Empty Chair. Mr.

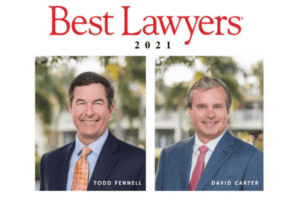

GCF Attorney’s Receive Best Lawyers Awards

Best Lawyers ® is unique in that it is the oldest and most respected peer-review publication in the legal profession. Selection to Best Lawyers is purely based on an exhaustive and rigorous peer-review survey (comprising more than 3.9 million confidential evaluations) resulting in its awardees setting the highest standard of

Reasons to Choose the Attorneys at Gould Cooksey Fennell

The law firm Gould Cooksey Fennell has been a member of this community for over half a century. Personal Injury lawyer David Carter has worked with Gould Cooksey Fennell for over 25 years, working on some of the area’s highest settlements and verdicts on the treasure coast and Indian River

Nine GCF Attorney’s Selected by Super Lawyers 2020

Super Lawyers credible rating service has recognized highly professional and tested attorneys for over 25 years. Nine of GCF’s Attorneys representing five distinct practice groups have been selected to the 2020 Florida Super Lawyers and Rising Star lists. David Carter, Troy Hafner, Chris Marine, Jason Odom, Eugene O’Neill and Sandra

Jason L. Odom achieves board certification in Civil Trial

Jason Odom recently achieved board certification as a specialist in Civil Trial by the Florida Bar Board of Legal Specialization and Education. Of all active Florida Bar members, under 2% go on to become board certified in Civil Trial. Created by the Florida Supreme Court in 1982, Board Certification is the

COVID-19: Does Your Company’s Business Interruption Insurance Apply?

COVID-19 Business Interruption Insurance Coverage The rapid spread of COVID-19 and corresponding government restrictions have severely limited and in many cases completely …

GCF Attorneys named to the 2019 Best Lawyers in America List

Gould Cooksey Fennell congratulates two attorneys who were selected by their peers for inclusion on The Best Lawyers in America© 2019 list. David Carter was recognized in the area of Plaintiff’s Personal Injury Litigation and Todd Fennell was recognized in the area of Trusts & Estates. For nearly three decades, Best

SECURE Act: New Rules Regarding Your IRA

Significant changes were made to the post-death required minimum distribution rules under the SECURE Act, which was signed into law on December 20, 2019. Under the new law, the general rule is that all IRA funds must be distributed to the beneficiary of the IRA within 10 years. There are

GCF Attorney Dillon Roberts Earns Florida Bar Board Certification in Tax Law

Dillon Roberts, LL.M. recently achieved board certification as a specialist in Tax Law by the Florida Bar Board of Legal Specialization and Education. Board certification is the highest level of evaluation by The Florida Bar of the competency and experience of attorneys in their area of practice. Dillon is now

Eight GCF Attorneys Selected to 2019 Florida Super Lawyer List

Super Lawyers credible rating service has recognized highly professional and tested attorneys for over 25 years. Eight GCF Attorneys representing five distinct practice groups have been selected to the 2019 Florida Super Lawyers and Rising Star lists. David Carter, Troy Hafner, Chris Marine, Jason Odom, Eugene O’Neill and Sandra Rennick

Proposed Regulations Dismiss Clawback Concern As To Large Gifts Made From 2018 Through 2025

In recent years, our federal transfer tax laws have provided us with very significant jumps in the exemption levels for gift tax and estate tax purposes, but coupled with an expiration date – a so called “sunset” – that prompts a reversion back to much lower exemption amounts. These “use

Two GCF Attorneys recognized by U.S. News’ Best Lawyers in America

We are proud to announce that two of our firms’ attorneys have been selected by their peers for inclusion in the 25th edition of the prestigious publication, the Best Lawyers in America© 2019. David Carter was recognized for his work on behalf of plaintiffs in the area of Personal Injury Litigation

Nine GCF Attorneys named to the 2018 Florida Super Lawyers List

Nine GCF Attorneys representing five distinct practice groups have been selected to the 2018 Florida Super Lawyers and Rising Star lists. David Carter, Troy Hafner, Chris Marine, Jason Odom, Eugene O’Neill and Sandra Rennick have all been selected to the Super Lawyers list and Anthony Guettler, Sean Mickley and Dillon

A Comparative Study Of The “Joint Spousal LLC”

By Anthony P. Guettler, Esq., Gould Cooksey Fennell, Vero Beach, Florida Limited liability companies (“LLCs”) are regularly used by senior family members to carry out their estate planning goals. An LLC can be used as a vehicle to manage the family’s wealth, protect assets, and transfer economic ownership to younger

Florida Appeals Court Upholds Verdict for Vero Beach Family Against Big Tobacco

On Wednesday, February 14th, a Florida Appeals Court upheld a verdict issued in 2015 by a jury in Indian River County that awarded Gould Cooksey Fennell client Robert Gore $2,000,000 in damages for the premature death of his beloved wife. Gloria, Mr. Gore’s wife, was one of millions of American

Employer-owned Life Insurance: Notice and Reporting to Avoid Tax

Many employers maintain life insurance policies on key employees. In addition to the obvious emotional toll the loss of a team member may have on the employer, a key employee’s sudden and permanent absence can also cause the employer immediate financial hardship. Life insurance on key employees allows the employer

The New Wealth Transfer Tax Laws and Their Impacts On Existing Estate Plans

NEW ESTATE, GIFT AND GST TAX LAWS On January 1, 2018, the current federal estate tax, gift tax, and generation skipping transfer (GST) tax exemption levels were increased dramatically to $11,180,000 per person ($22,360,000 combined for a married couple). These amounts will increase yearly, as they are indexed for inflation.